Denied Insurance Claims: Why Property Damage Attorneys Are Successful

When your property suffers loss and damage, you depend on your insurance to help you recover payment to repair and replace your damaged property. However, the reality is that insurance carriers often deny coverage for property damage claims. Even when coverage is afforded, the amount of the payment might not be sufficient to restore your property back to its pre-loss condition.

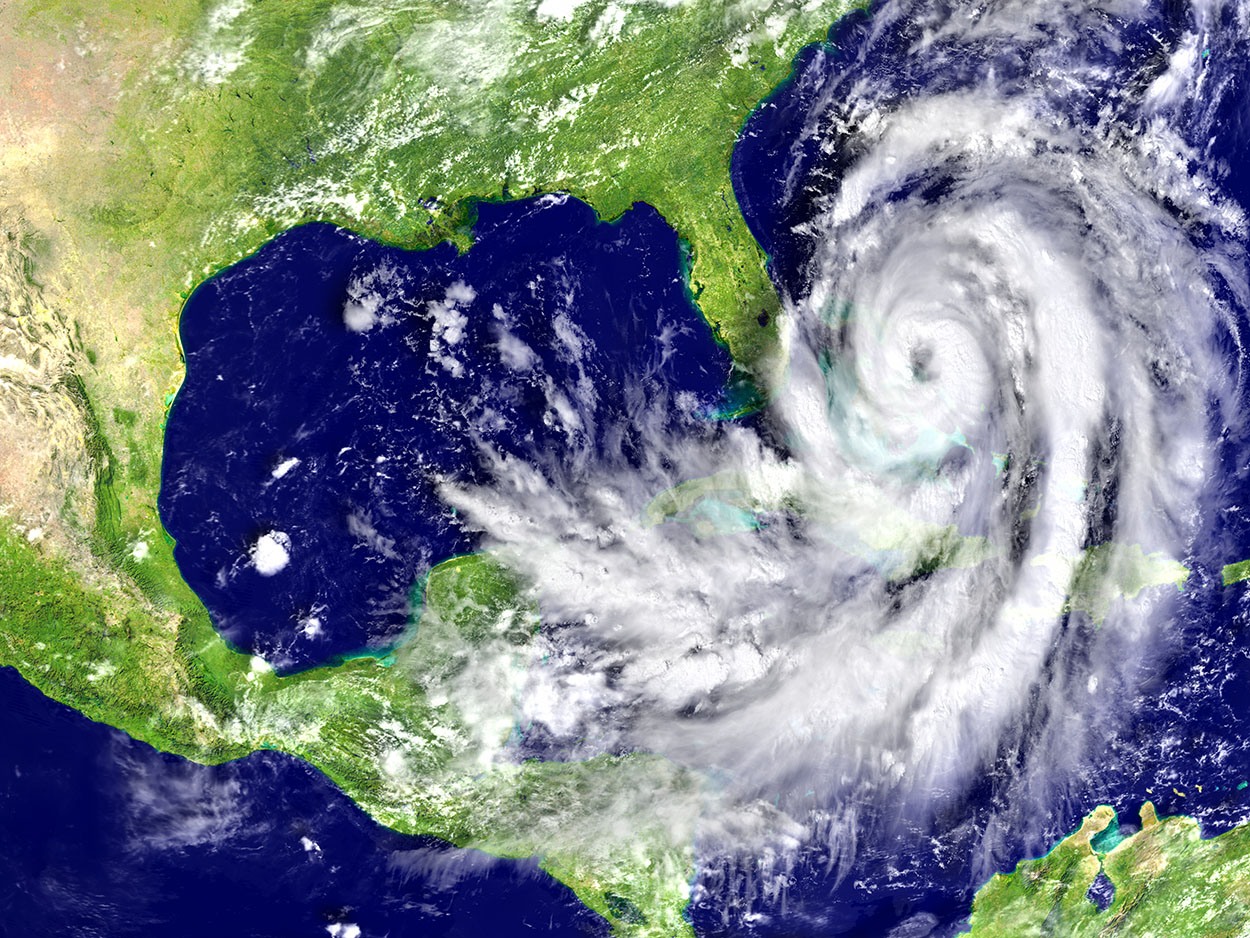

This even extends to catastrophic events that you're certain should be covered. For example, consider the fact that of the 17,005 residential property claims Florida citizens reported after Hurricane Idalia, 6,070 were closed without payment. That's a denial rate of more than 35%.

If an insurer has denied, underpaid or delayed your property damage insurance claim, you need an experienced property damage attorneys on your side to help you obtain the recovery to which you are entitled. With the right legal counsel in place, it's easier to see when you're being treated unfairly, and what your next steps should be. Today, we're sharing how an attorney can help you navigate the ins and outs of your property damage claim to enable you to obtain the proper recovery and provide you with peace of mind.

They Understand The Policy and Applicable Laws

To successfully obtained the proper recovery in a denied, underpaid or delayed insurance claim, you need to have a deep understanding of your insurance policy and the Florida insurance laws and govern your policy.

Insurers are banking on the fact that most citizens only have a baseline knowledge of how these statutes and rules work. When an insurance carrier issues a coverage denial letter, they typically list the reasons they denied your claim, including the policy terms, conditions and exclusions that they relied upon, as well as any applicable statutes. They may use complicated legal terms that may be difficult to understand for someone who is not used to dealing with such issues.

As you read through the explanation in the insurance company’s coverage determination letter, it might sound convincing. Many people take the documentation received from their insurance company at face value, file the letter away, and work to rebuild or repair their property without giving a second thought to challenging the insurance company’s determination of their claim.

However, your Florida property damage attorney will be able to advise you if a challenge to the insurance company’s determination is warranted. They'll carefully read the denial letter and your insurance policy in concert with the governing insurance statutes, including the changes recently enacted by the Florida Legislature, in order to evaluate your claim. If they believe that your insurance company has not property investigated and adjusted your claim, they can assist you in pursuing a recovery of the insurance proceeds to which you are entitled to rebuild your property.

Claims are Tricky to Handle When They Involve Multiple Causes of Loss.

Filing claims after Florida natural disasters can prove to be tricky. These emergencies often include multiple weather events and/or causes of loss at the same time (such as a combination of wind and flooding) and this can make a claim very complicated to adjust. This happened during Hurricane Ian which struck Florida in September 2022.

In the wake of Hurricane Ian many homeowners insurance companies took this as an opportunity to deny claims, asserting that the cause of damage was flood, not wind. By February 2023, nearly 40% of related insurance claims remained rejected or in limbo without payment, five months after the storm hit the Sunshine State.

Homeowners insurance companies claimed they issued denials on the basis of flooding, which most homeowners policies will not cover. Some homeowners who did receive a payout cited that it was only a few hundred dollars -- hardly enough to restore their homes to their pre-loss condition. An experienced property damage insurance attorney can help you sift through these complicated issues and assist you obtaining the recovery you deserve.

They Can Order an Independent Appraisal

If you don't see eye-to-eye with your insurance company on their adjustment of you claim, you may have the right under your policy to have an independent appraisal performed. This is a service you can leverage for denied insurance claims, as well as claims that have been underpaid.

During the appraisal, a third-party insurance appraiser will assess your property damage and share what they believe should be the scope and value of your loss and damages. In this way, it's similar to getting a second opinion at the doctor's office. Many insurance policies have terms that allow this service, but most property owners don't take advantage of it.

Your property damage attorney will read your policy to see if this is an option. If so, they can help you order and oversee the independent appraisal.

They Can Contest the Denial or Underpayment of Your Claim.

You don’t have to accept your insurance company’s denial or underpayment of your claim sitting down You can fight it If you believe your insurance company has not property investigated and adjusted your claim, an experienced property damage insurance attorney can assist you in pursuing a recovery of the insurance proceeds to which you are entitled to rebuild your property. Many times, this extra "push", backed by a reputable and experienced law firm, is what it takes to prompt insurance companies make a payment or a supplemental payment on a claim.

However, if your insurance carrier reviews the claim again and still fails to provide coverage or issue the property payment, you're not without recourse. From there, your lawyer can initiate litigation against your insurer to pursue a recovery.

Contact Our Property Damage Attorneys Today

Florida residents pay a lot of money in insurance policy premiums to protect what is usually their most valuable assets: their homes. In the unfortunate event that their property is damaged by a casualty loss, they deserve to know that their insurance will pay for the necessary repairs. After all, that is the very reason you pay for insurance. If you've experienced property damage loss and your insurance company has denied, underpaid or delayed adjustment of your claim, we're here to help you

At The Knoerr Law Group, our team of property damage attorneys can handle every aspect of your claim, so you don't have to stress. We have more than 50 years of combined litigation experience, and we know how to protect your rights as policyholder. To learn more about the services we can provide, contact us to schedule a free consultation.

‹ Back