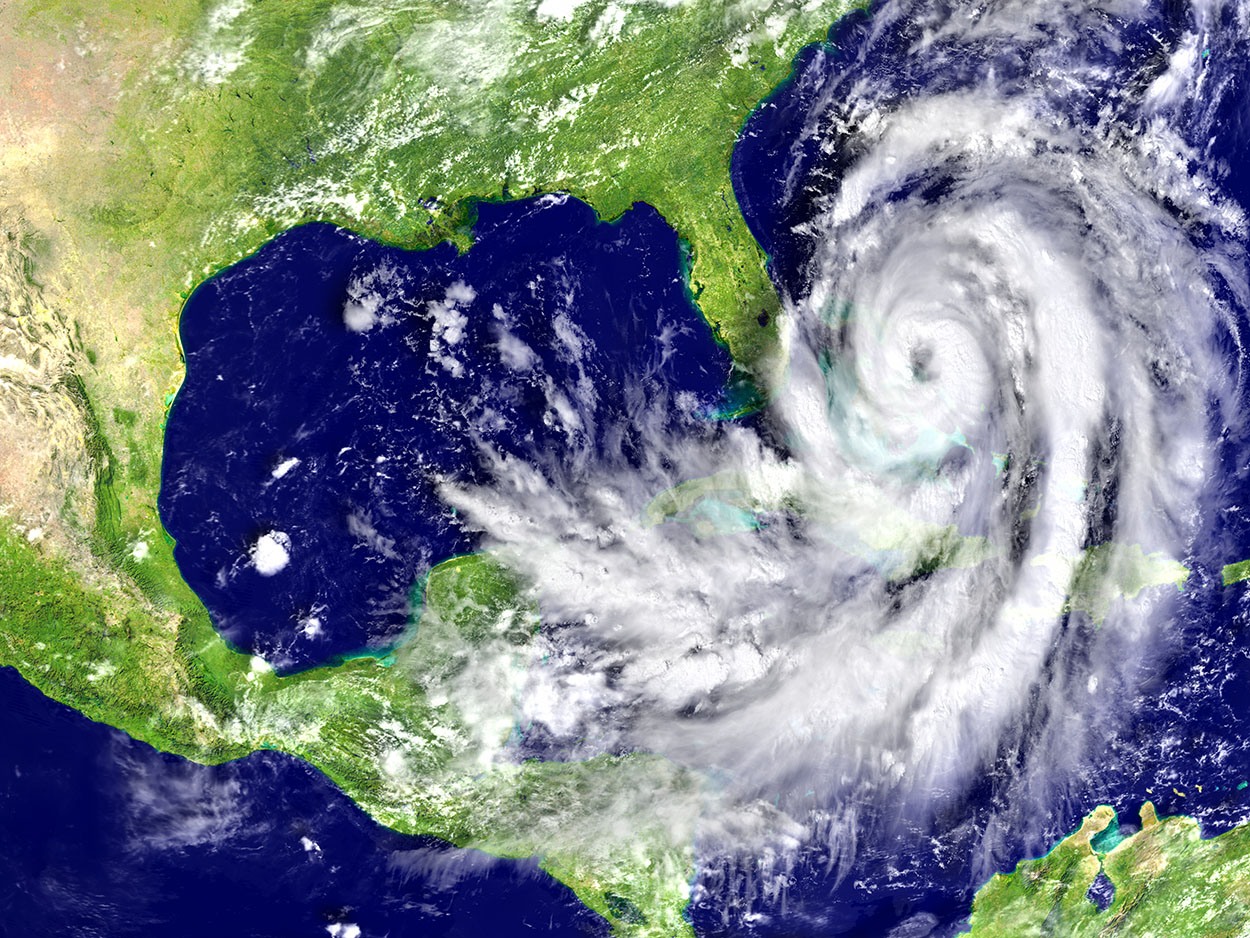

Prepare for Hurricane Season with Florida Property Insurance

According to the Congressional Budget Office, hurricane-related damages to private properties total around $54 Billion dollars a year. $34 Billion of that is for households alone.

If you have not taken the needed precautions to protect yourself and your property from hurricane season in Florida, now is the time.

Here's a simple guide to preparing for the season by getting the right Florida property insurance.

Before The Storm

Once the storm hits, the time for preparation has passed. Be sure and thoroughly photograph every side of your property before the storm begins. Make sure to get clear photos of the inside and outside to document the condition.

Using a phone is a great way to do this as you can attach dates to the photos--an aspect that will be important should you have to file a claim after the storm. If you have a reduced premium for shutters, make sure you photograph the shutters to document that they have been installed properly, prior to the storm.

It's also important to review your homeowner’s insurance policy and confirm with your insurance agent that your coverages are adequate for the current cost of construction. This will be essential to allow you to repair your property if you need to file a claim.

Another important step to prepping for a hurricane is to save important phone numbers for your insurance agent and company saved somewhere secure. If the storm forces you from your home, you'll want them on a phone or in a vehicle where they can be easily accessed.

Unfortunately, not all insurance claims will cover your losses.

This is where having the right Florida property insurance Policy and experienced professionals to assist you to make sure you have the right amount of coverage, which is your best means of protecting yourself.

2022 Hurricane Season in Florida

Mother nature has already warned us that this season may be tumultuous. Tropical storm Alex passed through Florida the very first week of hurricane season!

On May 23, 2022, Florida had a special session with governor Ron DeSantis to look into the property insurance crisis. Property insurance is purchased to protect your property from damages caused by storms, tropical storms, cyclones, tornadoes, and hurricanes.

Unfortunately, this special session did not result in refunds for property insurance, or lower premiums for property owners. However, the special session changes did provide insurance companies with funding for the reinsurers.

This will also help keep insurance companies in Florida in place.

How Does This Affect You?

It is urgent that you take a look at the insurance coverage amounts in your policies ...now. Don’t wait until after a storm hits to see what coverage you have.

Once the storm hits, the amount available to you for damages is set per your policy and it will be too late to change. One essential cost you want pay is to have enough funding for is a total home replacement.

Make sure your total home cost is covered entirely. This is especially important as all construction and property values have risen this year.

Supplies and a safety plan are vital preparation for hurricane season. However, knowing what your policy affords if your property is damaged is a piece of the puzzle you can't afford to overlook.

If Storm Damages Occur

Following the storm, and as soon as it is safe to do so, photograph the damages in detail. Make sure to capture photos of any damaged possessions inside the home as well. This will help you establish your damages in the claim process, as well as the date of the loss.

Next, it is important to file the claim with your insurance company as quickly as possible. Many insurance policies have language requiring prompt notice of any damages, whether or not the amount of damages exceeds your deductible.

Our team can assist you in filing your claim and provide you with any necessary help or documents you may need to get paid to replace damaged property and repair your home to its previous condition.

Review Your Florida Property Insurance Today

Contact your insurance agent today. Find out whether your assets are properly insured. Knoerr Law Group is here to assist you if any damage should occur.

Don't leave your protection to inexperienced hands. Our group offers over 50 years of combined experience should a dispute arise over damages. Contact us today if you need help protecting your rights. Please stay safe.

‹ Back