What to Do if You Get Pushback to Your Fire Damage Insurance Claim

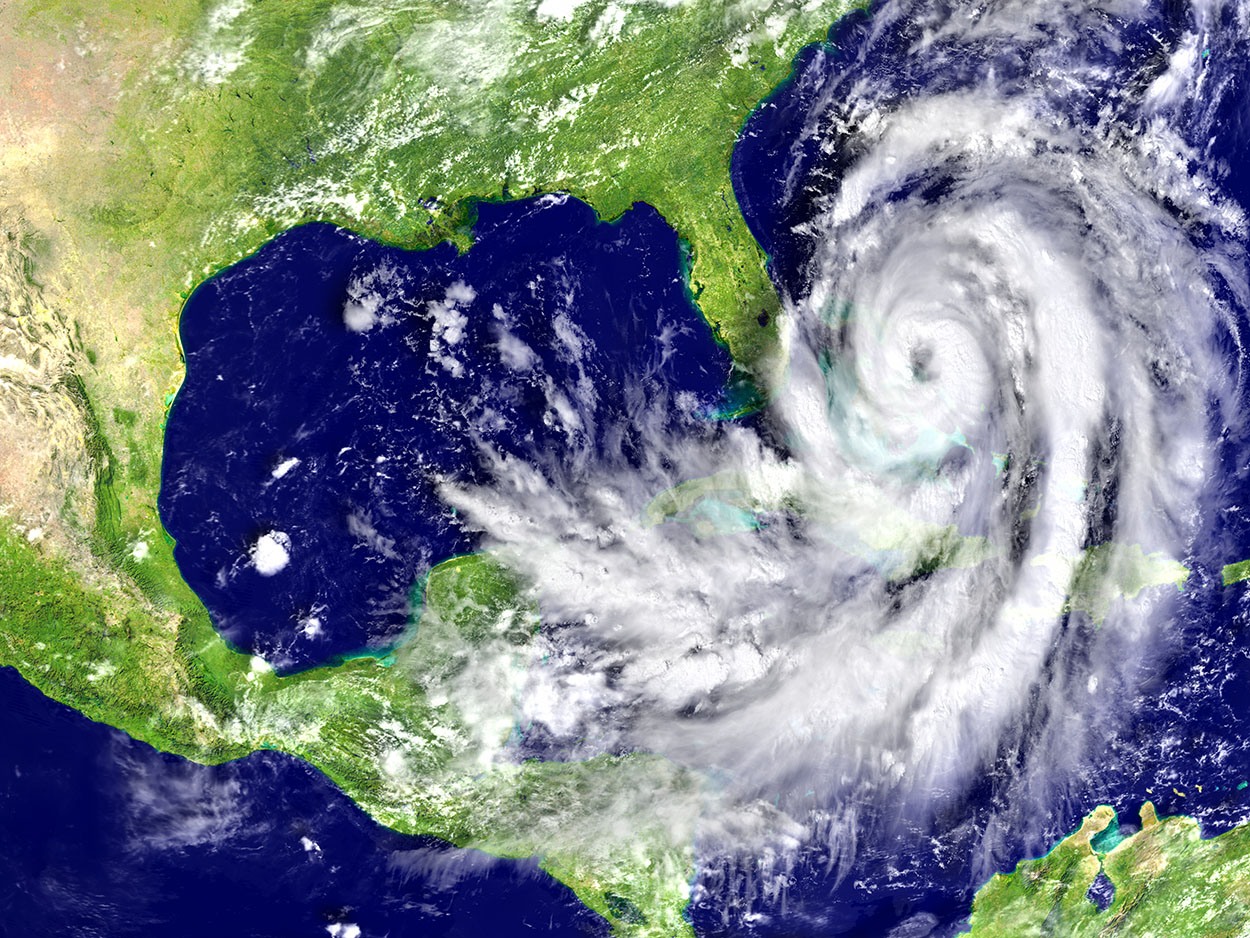

Across the United States, Florida has the third-largest number of properties at risk of fire damage, ranking only behind California and Texas.

Specifically, 3.9 million properties in the state (approximately 4 out of 10) are vulnerable to fire exposure.

In addition to natural disasters, there's also the risk of fire-related accidents. Of the 48,668 fires that occurred in Florida in 2019, 14,168 were non act of God events.

If your home or business has been damaged by fire, your insurance company should pay you to replace your property that were damaged from the fire or smoke if your policy of insurance has coverage. Yet, the process may not always go as expected.

If your insurance company does not fully pay for your fire damage insurance claim, we can help. In this post, we'll share the steps to take.

Understanding Florida's Valued Policy Law

Florida Statute 627.702 is also known as Florida’s Valued Policy Law. Our state is one of 20 states across the country that currently has such a law in place.

If your structure has been damaged by fire in any way, this is an important law to know.

Put simply, it states that if any building or structure experiences a total loss as a result of a covered peril, the liability for that loss will equal the amount of money for which the property was insured and coverages may exceed the stated amount on your declarations page of your property insurance binder.

The statute requires the insurer to pay the actual amount of the loss, placing the building in the same condition as it was before the incident occurred. If 80% or more of the property was damaged the VPL law comes into effect.

This law has existed in Florida for more than 100 years, yet there are still questions and misconceptions regarding it, the coverages provided and how to get your carrier to pay the total amounts needed, and these ambiguities can affect you in the event of a claim.

What If Your Fire Damage Insurance Claim Is Denied, Delayed or Underpaid?

You've loyally paid your premiums in full and on time. You expect your insurance coverage to kick in when you need it the most. That's why it can be frustrating to find that your insurer has underpaid or even flat-out denied your fire damage claim.

Any time you file a claim with your insurance, they must take the following steps and fully comply with your policy conditions that are listed for you as the homeowner to do once you have a loss, these include but are not only:

- Recognize the claim,

- Investigate it promptly and protect non-damaged property from being damages

- Photograph the damages,

- Contact your insurance company or insurance agent and get a claim number assigned;

- Cooperate with your insurance company and respond to your communications, also make sure they are doing the same; the law requires prompt responses from your carrier as well as fairly and accurately investigating the loss and paying the claim,

- Keep notes as to who you spoke to and what was said or asked for or hire a property attorney to take care of all of these steps and insure you get paid what is needed and owed;

- Avoid actions that would slow down the claim progression.

Unfortunately, we have come to learn that most of the time insurance companies aren't in the business of promptly and fully paying any claims. Fire claims would be expected to be easily identified and paid. Insurance companies are not in the business of losing money and will look for any reason to deny, delay or underpay your claim. They may claim that you didn't file on time, didn't document the damage properly, or even made false charges.

They may refuse to compensate you for the damage, or offer a settlement that's far less than you need or deserve. Thankfully, you can fight back.

Florida law allows residents to file a bad faith civil suit against an insurer if the company does not make a good-faith attempt to follow the steps described above.

Recently, the Second District Court of Appeal in Florida agreed that the date an insured or its attorney files a bad faith notice (Civil Remedy Notice) the court confirmed and ruled that residents start the clock on the filing date and provide the 60-day cure/correction period begins as soon as the insured files a civil remedy notice, not when the insurer receives it. However, to get to the bad faith aspect of damages an attorney must first have the court determine that you are correct and the insurance company breached the policy of insurance by not paying your claim.

These are important legal steps to know, but they can be confusing to navigate. That's where we come in.

Work With Our Team to Preserve Your Rights

At Knoerr Law Group, our Florida fire damage claim attorneys are well-versed in every aspect of state law. We have more than 50 years of collective experience and a track record of success in first-party claims.

We can recognize when your insurance company isn't working in good faith to process your claim in a fair and honest manner. Whether you're in the process of filing a fire damage insurance claim or you've already received an inadequate response, we can help.

Contact our team today to schedule a consultation and get started.

‹ Back