What You Need to Know About the $10k Water Limit for Insurance Policies

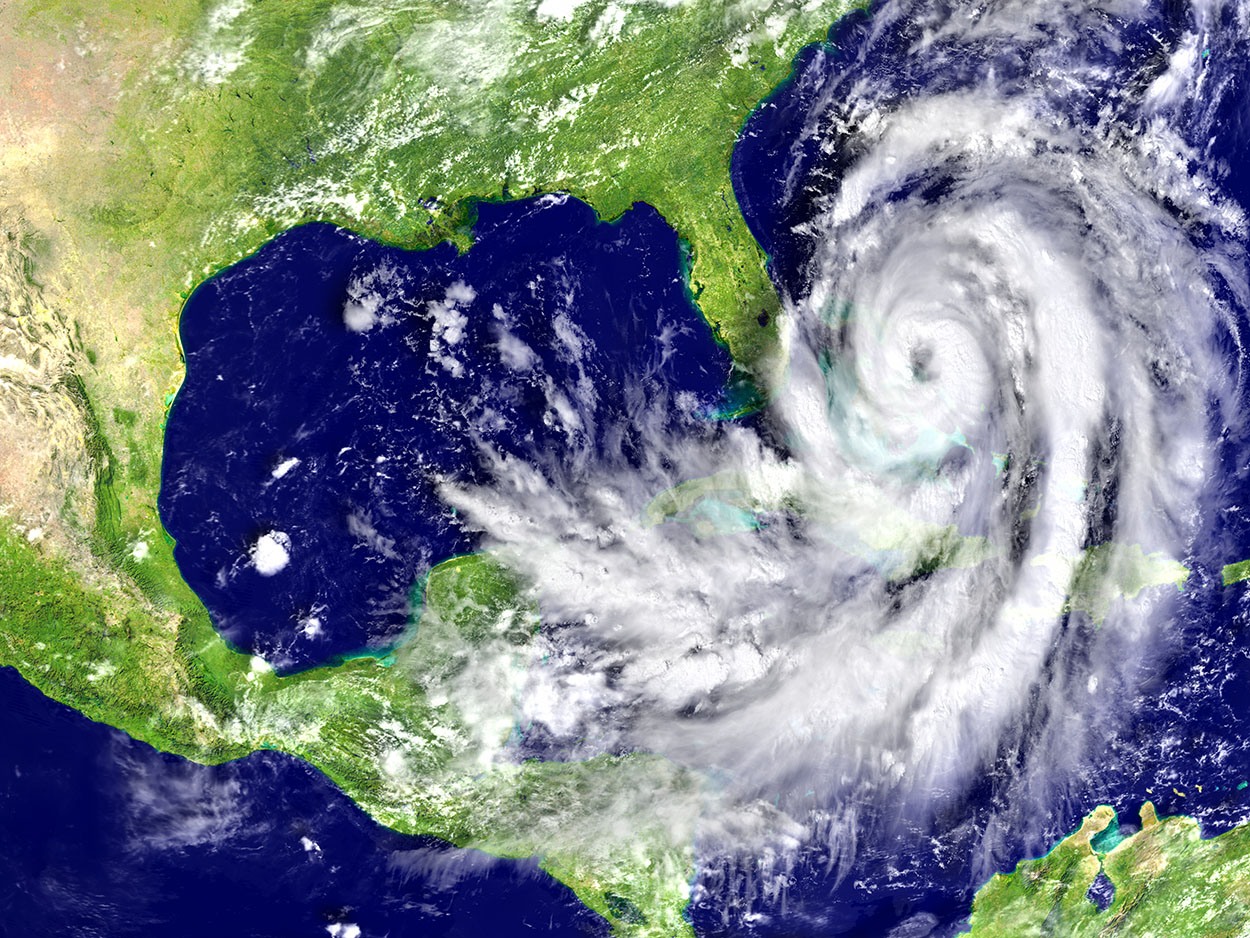

Did you know that Florida has been hit by a whopping 120 hurricanes since official records started keeping track in 1851?

From hurricanes and floods to burst pipes and other damages, there are many ways in which your property could experience significant water damage. You might be wondering what your insurance will do about it. This will depend on the limits of your particular policy.

Are you wondering what most limits involve? Keep reading to learn about the $10k water limit that many homeowner’s insurance policies have in them.

What the $10k Water Limit Means

It's an unfortunate fact that many insurance policies in Florida come with a maximum limit of $10,000 for water damages and an additional $10,000.00 for mold as a result of a water loss. If your repair cost is above your coverage limits, you may have some important choices to make. In some policies, like Citizens Insurance, the company will pay more than the $10,000.00 if you allow Citizens’ to take control of the repairs. In other instances once you are paid the limit for water damages, you'll be left to pick up the pieces and pay the tab.

One of the biggest questions involves what counts toward that $10,000.00 limit and what doesn't. For instance, you may be surprised to learn that most insurance companies will put the cost of drying out your property toward the limit or it may be separate coverage under emergency mitigation services. Depending on the severity of the water damage, the dryout alone could end up costing around $5,000, if not more. At that point, very little of the insurance provider's money will go toward repairing your property and getting it back to its “pre-loss condition”.

It's an understatement to say that this will end up being hard on your wallet. If you feel as though you're not being paid enough for your legitimate damages as claimed, then it's time to contact an attorney.

Why You May Need a Lawyer

By seeking out experienced Florida property damage lawyers, you'll have a much better chance of getting the coverage you deserve. The insurance industry receives the premiums annually and often do not fulfill the coverage amounts you pay for on you insurance claims. This is why property damage attorneys are not a variable but rather are often necessary.

The best lawyers will take your specific situation into consideration and create the strongest case possible. If you don't have any water damage claim issues at the moment, then a lawyer can let you know if your current policy is the correct values needed for coverage.

By finding an insurance provider you can rely on, you could avoid the stress of a lawsuit altogether. Either way, you can always rest easy knowing that an experienced attorney is by your side in every situation.

Now You Know About the $10k Water Limit

Now that you've learned about the new limits in property policies regarding the $10k water limit, you can make sure that you get what your insurance policy provider owes you. If you feel that your insurance policy isn't being honored, then it's worth getting legal assistance.

The Knoerr Law Group can help you by using its combined experience of almost half a century. From residential to commercial property in Florida, they've handled a vast number of first-party claims. In addition to your desired settlement, your insurance provider may have to pay the legal fees once you win your case. Contact us to schedule a consultation now.

‹ Back