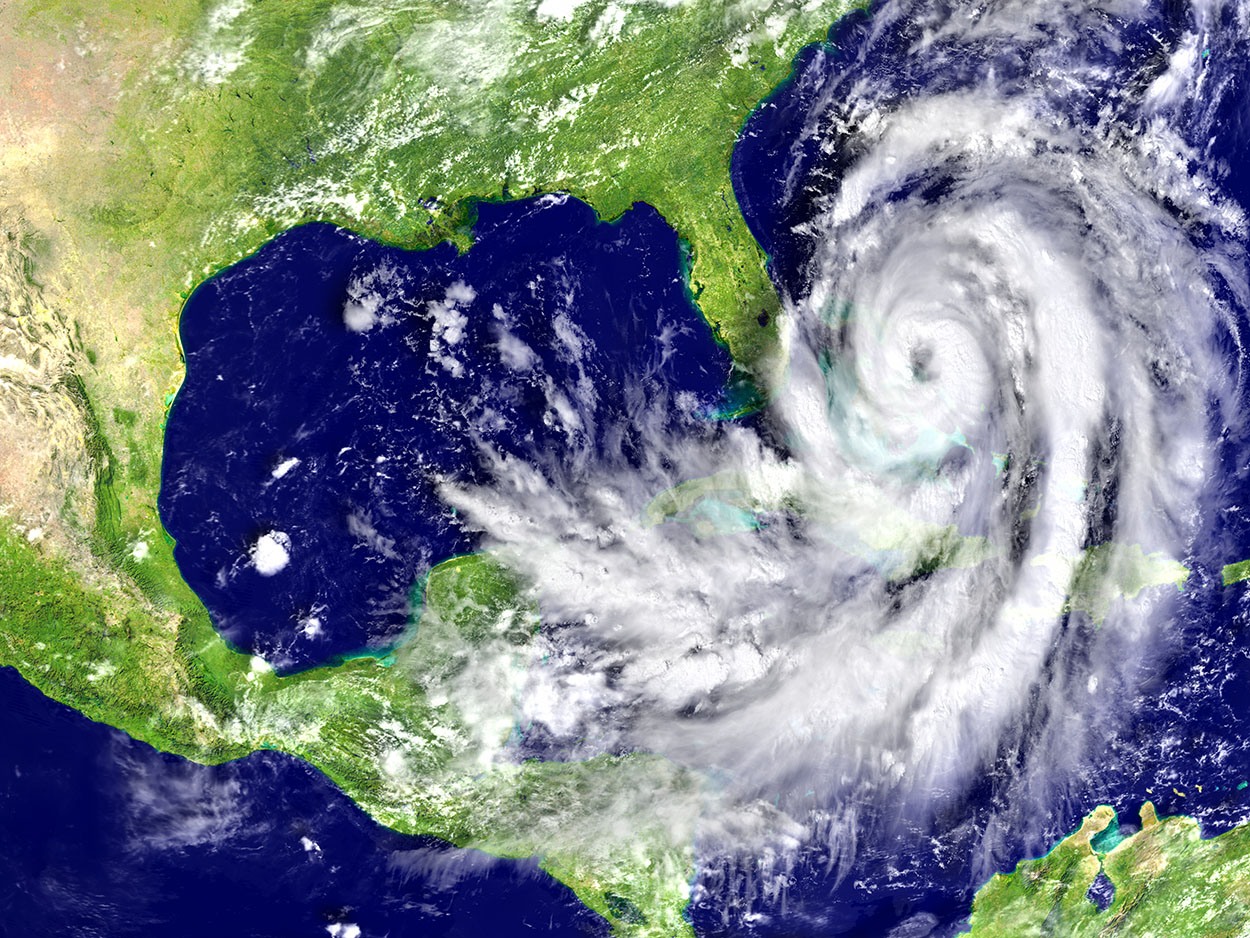

What You Need to Know for a Positive Property Resolution

Prompt Notification – The sooner the better! Your insurance company may require you to notify them of a claim, (whether a first-party claim for benefits or a liability claim that may be brought by a third party) within a short amount of time. It’s better to be safe than sorry. If you believe you have a loss – call in the claim and give the insurance company a “brief” description of the loss you believe you have.

Proof of Loss – Your policy likely requires you to submit a formal statement of your claim with enough facts and details for the carrier to be able to determine whether the claim is covered and the extent of its liability. The proof of loss statement must generally be signed by you, and it is not uncommon for the insurer to require that it be notarized as well.

Submit Documentation – Take photos that shows the damage immediately and secure an estimate to fix is as soon as possible. The insurer may require you to submit all documents, photos and records in support of your claim. This may be done independently or in preparation for an examination under oath (see below). Be sure to keep your own copies of all records and documents.

Examination Under Oath – Although not required in every instance, your policy may include a provision giving the insurance company the right to demand an examination under oath. This proceeding requires you to submit to questioning by the insurance company, which uses your answers in deciding issues such as coverage, liability and damages. As the name implies, you are sworn under oath to tell the truth in the presence of a court reporter who records the proceedings. Contacting an attorney before an examination under oath can be very helpful in preparing for the examination, and you will likely want your attorney present during the proceeding.

Be Ready For Insurance Company Defenses

You may have done everything right in submitting your claim. That doesn’t mean the insurance company won’t still try to find ways to deny or disclaim coverage. Many of these insurance company defenses are highly technical in nature and in order to refute them, you need the help of experienced insurance law attorneys who understand the technical aspects of complicated insurance policies that can argue the correct result to a judge or jury.

Policy Exclusions – One of the most difficult defenses to challenge occurs when the insurance company claims that one or more policy exclusions apply to the claim. Litigation in this area can be complex, focusing on complicated legal distinctions between policy exclusions versus policy limitations, and their effect on your claim.

Wear and Tear – If the carrier argues that your damage is due to normal wear and tear and not the event you are submitting your claim for, it may be necessary to hire experts in a particular field to examine the damage and present a written opinion or testify in court about the true cause of the damage.

Pre-Existing Damage – A favorite claim of the insurer is that your damage was caused by some earlier incident. The assistance of experts may be necessary here too. If there are records or documentation relating to any prior damage or repairs, be sure and share this knowledge with your attorney at the outset, so that you will be prepared to meet this defense.

Unpaid Premium or Rescission – Perhaps the least technical of all insurance company defenses is that your policy is not in effect because of an unpaid premium. Also, when you submit a claim, this is often the time when the insurance company goes back and pores over your initial application to determine whether any information may be inaccurate or incomplete. Florida law allows the carrier to rescind the policy based on an application that contains false or missing information. But when should a company review your application for accuracy? Before it approves you and accepts your premiums, or only after when you finally make a claim. A policy rescission motivated solely by a desire to avoid paying a valid claim may well be an example of insurance bad faith, and our attorneys will work to hold insurers accountable for such improper practices.

Prepare And Present A Strong Insurance Claim With Help From An Experienced Attorney

The insurance company would love to deny your claim because you did not fulfill your obligations under the policy. To make sure that doesn’t happen, or to be ready to challenge an insurance company denial, contact Linda Knoerr. Linda can guide you through the process and represent you in any dispute.

Contact us now for a free consultation.

‹ Back