Types of Property Damage Claims: What Floridians Need to Know

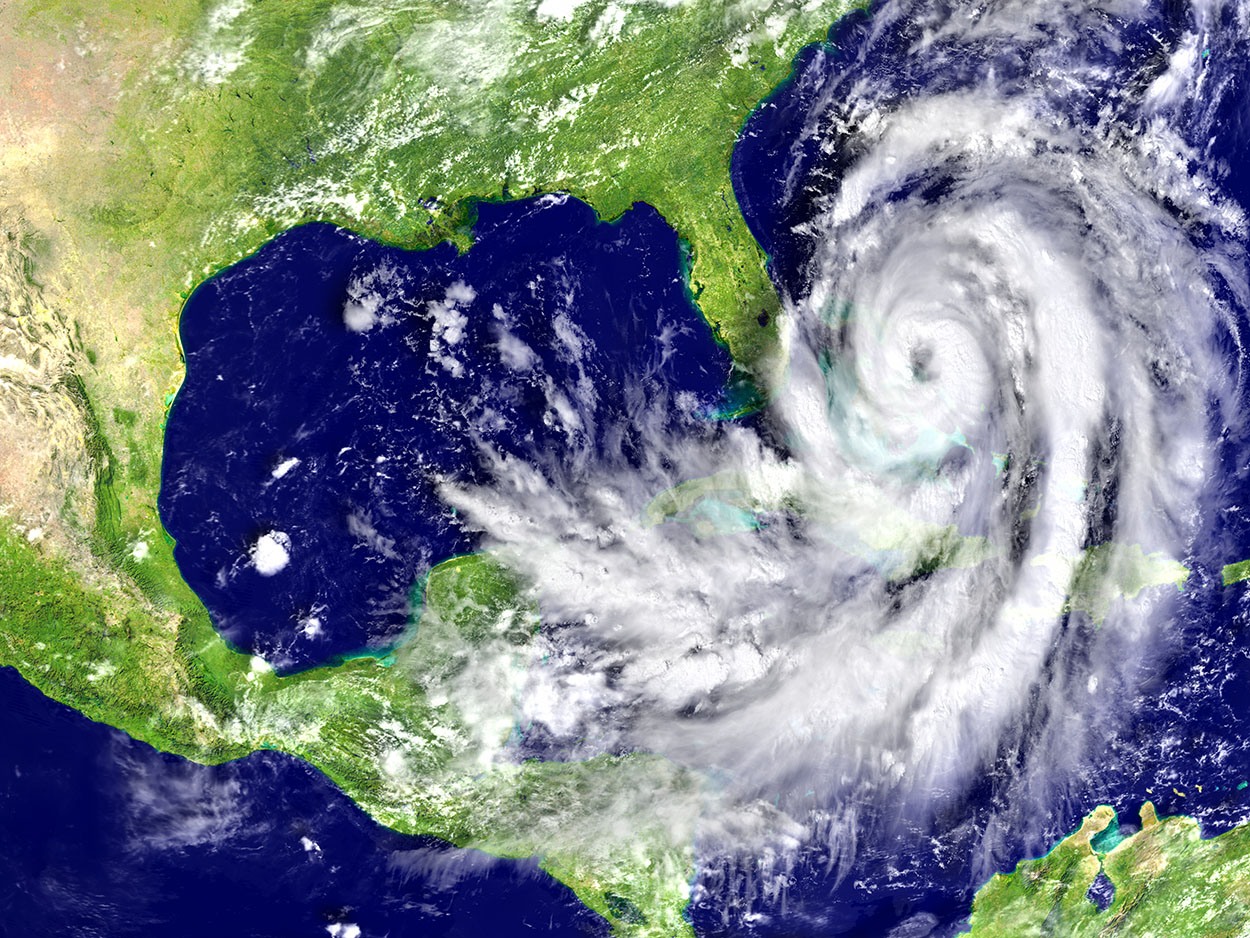

Hurricane Idalia hit Florida only a few months ago and left many properties damaged. While hurricanes and wind storms may be the first thing that comes to mind when Floridians think of property damage, there are several other types of causes of losses that can damage your home and commercial property or business. The good news is that you can purchase insurance to protect your home and personal property from the damage sustained from these losses with the proper coverage for the sustained damage. Hurricane related coverage is vital if you live in Florida. It is also vital to make sure that your insurance policy or policies contain the coverage you need and in sufficient amounts.

This raises an important question: What types of property damage are there that are covered for by typical homeowners or property coverage for which you can make a claim? There are several types of claims that Florida property owners typically make. We'll discuss them here.

What Is Property Damage?

First, it is important to know what property damage is that is covered under insurance generally. While this seems obvious, it is more complicated. There are several types of property that can be damaged and covered under most homeowners insurance policies: The first type is Real Property. This is typically covered under the “dwelling” coverage your home, building structure, etc.). The second type is Personal Property. This is the contents, such as furniture, clothing, electronics, inventory, etc.) Physical damage to property occurs when your property is damaged or destroyed from a loss that is covered under your terms of insurance. There are other types of losses that can cause damage to you as a result of the physical structural or property damage.

What Types of Property Damage Claims Are There?

Some common types of property damage in Florida:

- Hurricane and Wind Storm

- Water damage from a plumbing system

- Mold

- Hail

- Fire

- Lightning

- Sinkhole / sudden ground collapse

- Vandalism and Theft

- Accidental damage / Negligence

- Flood *

*Flood damage is not typically covered under homeowners insurance policies and usually must be obtained by purchase of a separate flood policy.

You should also be aware that certain insurance carriers do not provide all of the coverages listed above and it may be necessary to purchase separate policies to obtain all of the coverages you may need.

Wind Damage Claims

With the recent string of hurricanes and tropical storms in Florida, wind accounts for a significant amount of Florida property damage. Hurricane Idalia was a Category 4 hurricane, with winds over 130 mph.

Severe winds can cause serious damage and a massive uptick in insurance claims. But wind damage does not always come from a hurricane. Wind damage is a common insurance claim even when there isn’t a named storm that caused the damage.

Water and Flood Damage Claims

It is important to understand the difference between water damage claims and flood claims. Water damage claims that are covered under homeowners insurance policies are caused by sudden and accidental losses that result in water damaging your home and property. One example is plumbing loss, such as a burst water pipe. Your homeowners insurance policy may also cover water damage from rain that comes into your home from a peril-created opening in your property, such as a leak in your roof from flying debris or a lightning strike. On the other hand, flood damage is damage typically caused from rising water that comes from outside your home. As stated above, flood damage is not typically covered under homeowners insurance policies and usually must be obtained by purchase of a separate flood policy.

Water can cause a significant amount of damage to your home. If you have suffered water damage of any kind, your next step is to file an insurance claim. Remember that insurance companies often don't pay what they owe or don't do it quickly. If this happens, we suggest hiring a property damage attorney.

Criminal Property Damage

Losses caused by weather events and natural disasters can be devastating, but some types of property damage are done by other humans, either intentionally or unintentionally. These include negligence, vandalism and theft. Fortunately, most insurance policies provide coverage for these types of losses.

When filing insurance claims in cases involving theft or vandalism, call the police to report the incident and obtain a copy of the police report. Promptly report the loss and damage to your insurance company, and make sure to write down all the damage carefully to document your damages.

Understand the Types of Property Damage Claims

There are many types of property damage claims in Florida which you might experience.

Recent laws have helped insurance companies manage the heavy storm events in Florida, but some claims will fall through the cracks. If you want to file a property damage claim, please get in touch with us at Knoerr Law Group.

‹ Back